Fraud Detection: How Machine Learning Can Help Reduce Marketing Expenses and Increase ROI

As technology advances, fraudsters are finding new ways to exploit vulnerabilities in the system to engage in fraudulent activities. These activities include chargeback fraud, account takeover, and click fraud. In this blog post, we will explore how machine learning can be used to detect and prevent these fraudulent activities, thereby reducing marketing expenses and increasing return on investment (ROI).

Chargeback Fraud

Chargeback fraud occurs when a customer disputes a legitimate charge and initiates a chargeback, resulting in the merchant losing revenue. Merchants are then forced to spend resources investigating the chargeback and, in some cases, disputing it. This process is time-consuming and costly and can harm the merchant’s reputation.

Machine learning can be used to detect chargeback fraud by analyzing customer behavior. By analyzing a customer’s purchase history and spending patterns, ML algorithms can identify suspicious transactions and flag them for review. Additionally, ML can analyze the customer’s device and location to determine if the transaction is being made from a known fraudulent location.

Account Takeover

Account takeover occurs when a fraudster gains access to a customer’s account by stealing their login credentials. Once the fraudster has access, they can make unauthorized purchases, steal personal information, or engage in other fraudulent activities. Account takeover is particularly problematic for merchants who rely on recurring revenue streams.

Machine learning can be used to detect account takeover by analyzing the user’s behavior. By analyzing login patterns, device usage, and transaction history, machine learning algorithms can detect suspicious activity and flag it for review. Additionally, machine learning can detect anomalies in the user’s location, device, and behavior to determine if the account has been compromised.

Click Fraud

Click fraud occurs when fraudsters engage in fake clicks to drive up the cost of pay-per-click advertising. This is particularly problematic for advertisers who rely on pay-per-click advertising to drive traffic to their website.

ML can be used to detect click fraud by analyzing user behavior. By analyzing the user’s device, location, and behavior, ML algorithms can identify suspicious activity and flag it for review. Additionally, ML can analyze the click-through rate of the advertisement and determine if it is consistent with industry standards.

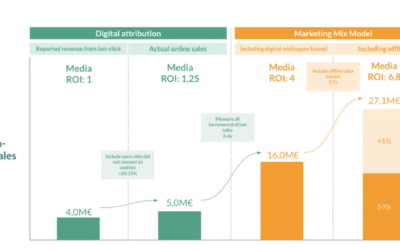

Reducing Marketing Expenses and Increasing ROI

By using machine learning to detect fraudulent activities, merchants can reduce marketing expenses and increase ROI. Merchants can avoid the cost of investigating and disputing chargebacks by preventing chargeback fraud. By preventing account takeover, merchants can avoid the cost of lost revenue and reputational damage. By preventing click fraud, advertisers can avoid the cost of paying for fake clicks.

Additionally, by preventing fraudulent activities, merchants and advertisers can increase ROI. By ensuring that legitimate transactions are processed, merchants can increase revenue. By ensuring that pay-per-click advertising is legitimate, advertisers can increase the effectiveness of their advertising campaigns.

To conclude, machine learning can be a powerful tool for detecting and preventing fraudulent activities such as chargeback fraud, account takeover, and click fraud. By using machine learning to detect fraud, merchants and advertisers can reduce marketing expenses and increase ROI. As technology continues to advance, machine learning will become increasingly important in the fight against fraud.

Image by Freepik